In a classic 2008 Fred Wilson post called Trading Analog Dollars For Digital Pennies, the legendary venture investor quotes then NBC Universal CEO Jeff Zucker, who famously warned the media industry "that we do not end up trading analog dollars for digital pennies."

Fast forward to today and you have the Wall Street Journal detailing the struggles facing the traditional retail industry in J.Crew’s Mickey Drexler Confesses: I Underestimated How Tech Would Upend Retail. Entrepreneur and thought leader Richie Siegel brilliantly breaks down how retailers have miscalculated changing consumer behavior in Mickey Drexler and the death of a supply-driven world, a must read for every retailer. Siegel writes that retailers “are caught in the middle of one of the most profound but little talked about shifts in the retail and apparel space: the shift from a supply driven world to a demand driven world, and the cultural change needed to thrive today.”

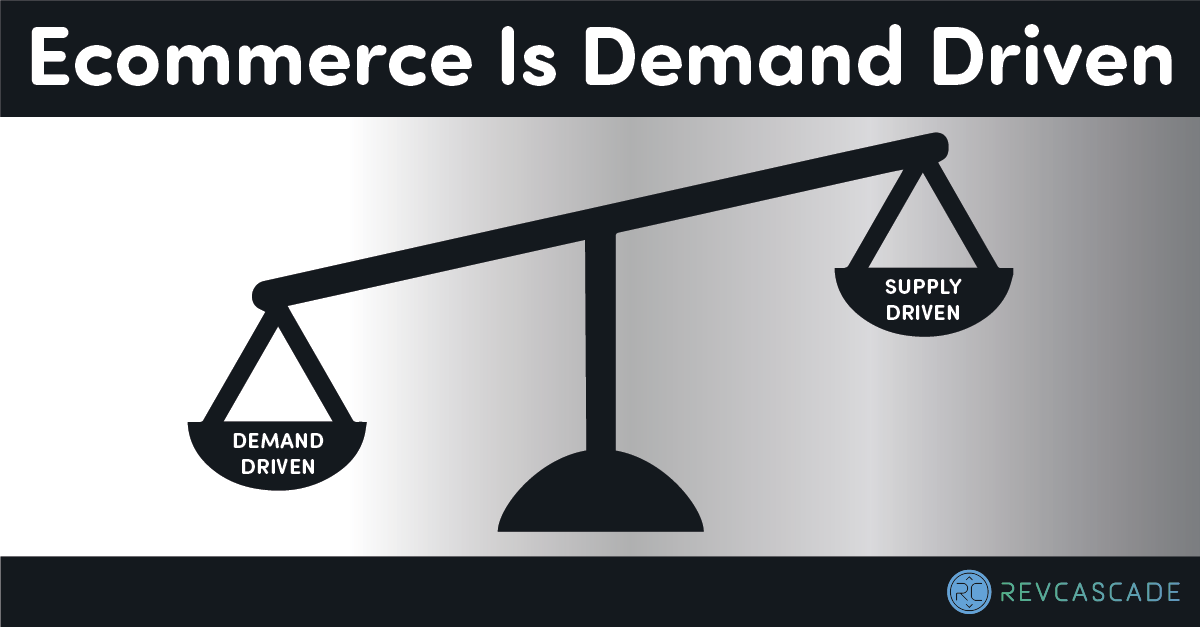

This shift parallels the struggles faced in the early 2000s by newspaper publishers and media companies who also miscalculated the impact the internet would have on their industry. For their entire existence, newspapers enjoyed a local monopoly. If consumers in that local market wanted news, in an analog world the local newspaper had a lock on their attention—and a lock on advertising dollars in that local market. Then along came digital, globalizing access to news and sending the newspaper industry into freefall:

Fred Wilson captured this perfectly in his 2008 analog to digital post: “Analog and digital, it turns out, are polar opposites. Analog has physical costs which lead to scarcity driven business models. Digital has zero marginal cost (or near zero) which leads to ubiquity driven business models.”

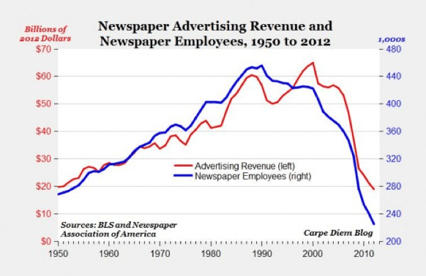

We are now living in a time where the traditional retail industry is experiencing its own freefall in the face of the analog-to-digital shift—a transition that has not been kind:

Just like the media industry struggles, these traditional retailers are struggling because they are failing to adapt and embrace the opportunities that this new demand driven era has presented. For starters, their analog business has significant physical costs. By far, the biggest cost on every retailer’s balance sheet is inventory. Retail buyers talk about “open to buy”—their budget to buy more inventory—which is a constraint. Physical shelf space is another constraint. With inventory costs and limited shelf space, retailers’ sales are limited by how much inventory they can buy and how quickly they can sell it.

When the internet came along, nearly every retailer treated their ecommerce site just like another store. They applied their analog business model to a digital world, limiting their upside.

Contrast that with today’s biggest internet retailers in the world. The combination of Alibaba, Amazon’s Marketplace, and Ebay alone generates over 40% of global ecommerce sales. These retailers are winning by applying a new strategy in the demand driven world.

While Amazon justifiably dominates the business headlines, it’s worth noting that last year Alibaba became the biggest retailer in the world. Not ecommerce retailer. Retailer. Bigger than Amazon. Bigger than Walmart. Alibaba will generate more than $500 billion in retail sales this year. Alibaba became the biggest retailer in the world by deploying the ultimate demand driven world strategy.

More recently, vertical online retailers are experiencing comparable success thanks to adopting similar strategies. Think Wayfair, Zalando, 1st Dibs, and Etsy, or rising ecommerce players like children’s clothing, accessories, and homegoods retailer Maisonette or jewelry retailer Ice.

Wayfair, for example, generates over $4 billion in retail sales by selling 8 million products from 10,000 manufacturers. In a demand driven world Wayfair dwarfs the online sales of every traditional homegoods retailer.

More specifically, though, Wayfair’s massive product assortment is what truly differentiates it. Most traditional homegoods retailers, constrained by their analog business model, sell less than 1% of the products available to sell on Wayfair. In fact, many are less than 0.1%. In a demand driven world, Wayfair is winning because they offer 8 million products while traditional homegoods retailers offer 8,000.

Similarly, Amazon dwarfs department stores and specialty stores with their product assortment. ScrapHero estimates that Amazon offers nearly 400 million products.

The biggest ecommerce retailers all share one common thread: They carry no inventory.

In this shift from analog to digital, from a supply driven world to a demand driven world, what should traditional retailers big and small do in order to thrive in the future? The answer is quite simple: In a demand driven world, retailers must think differently about their supply.